Content

This may sound confusing, but remember the cost of goods sold only considers the direct materials involved in producing the items you’re manufacturing. With semi-variable overhead costs, there will always be a bill , but the amount will vary . In economics, revenue curves are often illustrated to show whether or not a business should stay in business, or shut down.

By upgrading older equipment to better new ones, you can produce more for the same amount of resources. Training your employees can also increase their efficiency, giving you better results per person instead of simply hiring more.

What is included in manufacturing overhead?

This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more. Manufacturing overhead is also known as factory overheads or manufacturing support costs.

This will tell you how much overhead should be applied to each production unit. Review the payroll and maintenance records to find the total allocation base generated in the previous accounting period.

Journal Entry To Record Manufacturing Overhead Cost:

Is calculated prior to the year in which it is used in allocating manufacturing overhead costs to jobs. A rate established prior to the year in which it is used in allocating manufacturing overhead costs to jobs. Period expenses are closely related to periods of time rather than units of products. For this reason, firms expense period costs in the period in which they are incurred. Accountants treat all selling and administrative expenses as period costs for external financial reporting.

Does gross profit include labor and overhead? – Investopedia

Does gross profit include labor and overhead?.

Posted: Sat, 25 Mar 2017 19:43:18 GMT [source]

Ask other facilities if they have extra equipment or materials that they’re not using – and if it could be “redeployed” to your factory. Redeployment would save time and money in searching for and installing brand-new equipment while decreasing your overhead costs. For example, let’s say last year’s sign factory overhead – between incidental employment costs and other expenses – cost $1,500,000. We expect the factory to be as productive as last year, with no extra labor costs or contract changes. Many employees receive fringe benefits—employers pay for payroll taxes, pension costs, and paid vacations. These fringe benefit costs can significantly increase the direct labor hourly wage rate.

Understanding Overhead

Even if you run a relatively waste-free business, there’s always room for improvement. Consider recycling and reusing metals and other materials instead of throwing them away.

- Cost accountants can use straight-line depreciation to allocate depreciation costs based on a number of factors, such as the number of products produced or square footage of the building.

- But don’t forget indirect labor costs, which are costs incurred in the production process, but not considered direct labor.

- Changes in product design and vendor specifications could reduce the part count from 700 to 200.

- Knowing how to calculate manufacturing overhead provides valuable insights into the quality and efficiency of your business.

Manufacturing overhead includes any cost related to a completed product, not considered a direct cost. In this article, we will discuss how to calculate manufacturing overhead and why it matters. Applied overhead is a fixed charge assigned to a specific production job or department within a business. Depending on the nature of the business, other categories may be appropriate, such as research overhead, maintenance overhead, manufacturing overhead, or transportation overhead.

Step 4: Divide The Amount Of Manufacturing Overhead By The Allocation Base

Variable overhead costs are directly affected by the volume of output. Such variable overhead costs include shipping fees, bills for using the machinery, advertising campaigns, and other expenses directly affected by the scale of manufacturing. Manufacturing overheads are all costs endured by a business that is within the physical platform in which the product or service is created.

Activity-based costing aims to reduce the proportion of costs treated as overheads by allocating costs to each activity involved in the production of a product or delivery of a service. As well as refreshments, meals, and entertainment fees during company gatherings. Despite these costs occurring periodically and sometimes without prior preparation, they are usually one-off payments and are expected to be within the company’s budget for travel and entertainment. This includes the cost of hiring external law and audit firms on behalf of the company. This would not apply if company has own internal lawyers and audit plans. Due to regulations and necessary annual audits to ensure a satisfactory work place environment, these costs often cannot be avoided. Also, since these costs do not necessarily contribute directly to sales, they are considered as indirect overheads.

Terms Similar To Factory Overhead

Other companies include fringe benefit costs in overhead if they can be traced to the product only with great difficulty and effort. Quick Study’s Accounting 2 presents a simpler way to determine manufacturing overhead for a company called A-1 Printers.

Overhead should be included in the valuation of both finished goods and works in progress. Suppose, you use the Labor Hour Rate to calculate the overheads to be attributed to production.

Prime Costs vs. Conversion Costs: What’s the Difference? – Investopedia

Prime Costs vs. Conversion Costs: What’s the Difference?.

Posted: Tue, 08 Jun 2021 07:00:00 GMT [source]

Manufacturing overhead costs are product costs because they are not expensed out in the period in which they are incurred but are capitalized as part of the cost of inventories. A simple illustration of step four can be constructed by using units of production as the activity base. If the estimated overhead expenses were $400,000 and the projected number of units was 350,000 ($400,000/350,000), then the per unit overhead expense would be $1.14. Hence, if a company had a production goal of 100,000 units, it would asign overhead expenses of $140,000 ($1.14 multiplied by 100,000) to this goal. Hence, if a company had a production goal of 100,000 units, it would assign overhead expenses of $140,000 ($1.14 multiplied by 100,000) to this goal. One company, for example, found that its quality transaction system was collecting and keeping quality data on every possible activity—despite the very poor quality of its products. The quality department often complained that it never had time to analyze the data, which just sat in file cabinets and computer files, because it spent all its time collecting.

How Can Calculating Your Manufacturing Overhead Reduce Costs?

The allocation base is the basis on which a business assigns overhead costs to products. The commonly used allocation bases in manufacturing are direct machine hours and direct labor hours. Manufacturing overhead, therefore, does not include direct materials or direct labor costs. It is “the total cost involved in operating manufacturing overhead costs include all production facilities of a manufacturing business that cannot be traced directly to a product”. If a company’s production process is highly mechanized (i.e., it relies on machinery more than on labor), overhead costs are likely driven by machine hours. The more machine hours used, the higher the overhead costs incurred.

- Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year.

- You need to determine the allocation base through the factory’s maintenance and payroll records in the current period.

- But in the “hidden factory,” where the bulk of manufacturing overhead costs accumulates, the real driving force comes from transactions, not physical products.

- Consider setting aside an amount over your estimate to account for any potential repairs or other unforeseen costs.

- Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities.

Moreover, in today’s environment, production managers have more direct leverage on improving productivity through cutting overhead than they do through pruning direct labor. Overhead is overapplied because actual overhead costs are lower than overhead applied to jobs. Second, the manufacturing overhead account tracks overhead costs applied to jobs. The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account.

Manufacturing Overhead Costs

A second and perhaps more serious problem occurs when manufacturers automate transactions that are not really necessary in the first place. After installation the company found that it had simplified the transaction flow so much that no automation was necessary after all. Perhaps the most important means of automating transactions is using computer systems that are so well integrated that data need only be entered once. In virtually every large company, however, there is still a massive redundancy of transactions due to the existence of subsystems that cannot “talk” to one another.

For example, if Company A is a toy manufacturer, an example of a direct material cost would be the plastic used to make the toys. For utilities and commercial property insurance, use your previous year’s total annual bill for water, electricity, and gas, then increase by at least 3% to account for inflation.

Chapter 1: Nature Of Managerial Accounting And Costs

The company must account for overhead expenses to determine its net income, also referred to as the bottom line. Net income is calculated by subtracting all production-related and overhead expenses from the company’s net revenue, also referred to as the top line. Now that you know a little bit about manufacturing overhead, you might be wondering how to reduce these costs. Well, the good news is that business owners can typically reduce the costs by performing some simple steps, one of which is to shop around for utilities. When was the last time that you checked prices for utilities like electricity, gas and water in your area? Therefore, they end up overpaying for monthly utilities, increasing their total overhead. Shopping around and getting price quotes from multiple service providers, however, can easily save you hundreds if not thousands of dollars per year in utility costs.

- Thus, you first need to sum up all the indirect expenses that you incur.

- Furthermore, this will remain constant within the production potential of your business.

- Second, the manufacturing overhead account tracks overhead costs applied to jobs.

- Once you have calculated your indirect costs, you must complete another calculation, your manufacturing overhead rate.

- The company must account for overhead expenses to determine its net income, also referred to as the bottom line.

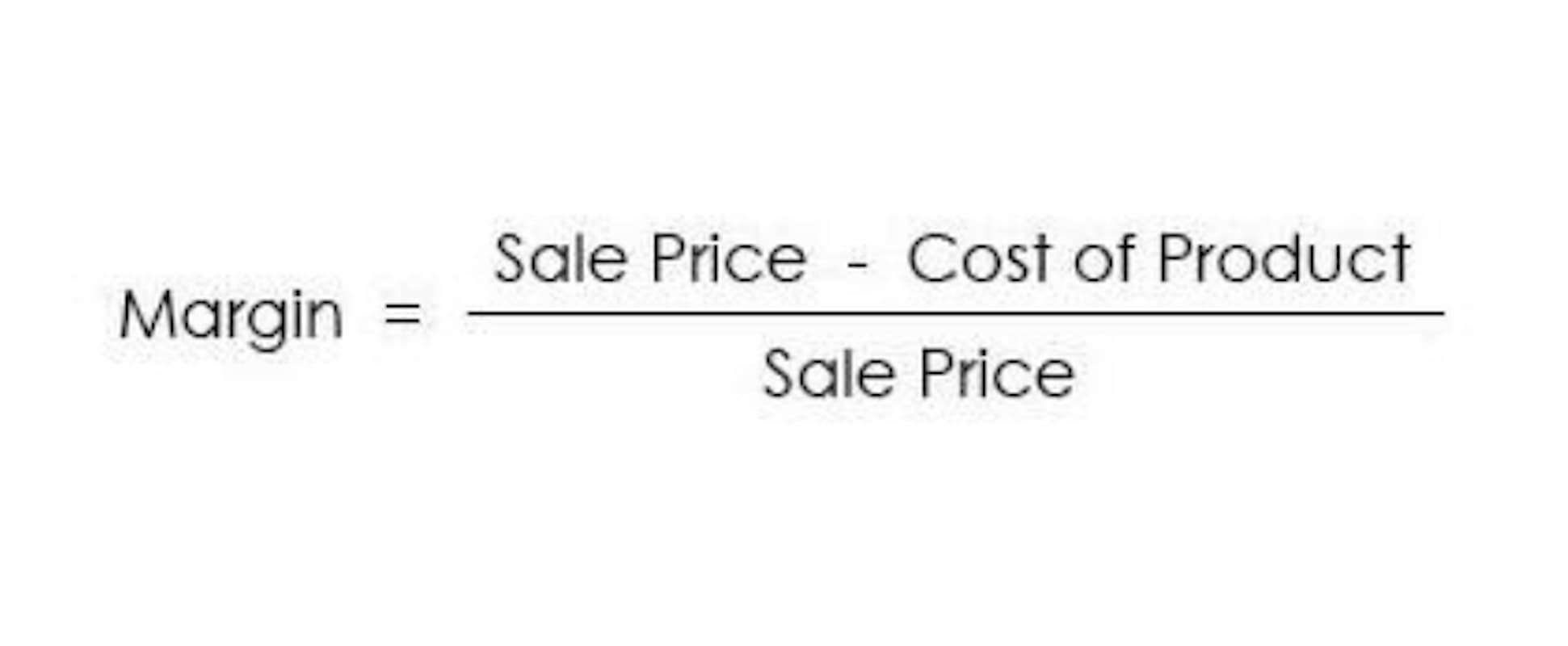

If your manufacturing overhead rate is low, it means that the business is using its resources efficiently and effectively. On the other hand, a higher rate may indicate a lagging production process. To compute the overhead rate, divide your monthly overhead costs by your total monthly sales and multiply it by 100.

To calculate manufacturing overhead, you need to add all the indirect factory-related expenses incurred in manufacturing a product. This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more. Plant depreciation, insurance, property taxes, rent, etc. are examples of fixed manufacturing overhead costs.

As a result, the company would need to send only one check per month to each vendor for goods actually received. Change transactions, which update basic manufacturing information systems to accommodate changes in engineering designs, schedules, routings, standards, materials specifications, and bills of material. These transactions involve the work of manufacturing, industrial, and quality engineers, along with a portion of the effort expended in purchasing, materials control, data entry, and data processing.

Author: Kim Lachance Shandro

Be the first to comment on "How To Distinguish Direct From Indirect Manufacturing Costs"