Content

Since then, he has contributed articles to a variety of print and online publications, including , and his work has also appeared in poetry collections, devotional anthologies, and several newspapers. Malcolm’s other interests include collecting vinyl records, minor league baseball, and cycling. Keep in mind, there are no Generally Accepted Accounting Principles that mandate how we must do a process cost report.

This will allow those additional factors to even out over time. In simple, how much cost is consumed while bringing a new customer for your product or service is cost per acquisition. Try it nowIt only takes a few minutes to setup and you can cancel any time. Try it now It only takes a few minutes to setup and you can cancel any time.

Conversion Costs Definition

Second, not all your competitors will be as proactive as this. In the long run, these minor changes can help you leave your competitors behind. To make good use of this marketing metric, you should know how to calculate it. And before calculating it, you must have a clear understanding of it.

We only suggest a pre-conversion inspection for buildings where a significant amount of work has been completed without building permits. You do not need to meet modern Building Code standards to convert, but most buildings will require some repairs and alterations. The official requirements are to eliminate or legalize work that has been done without proper building permits, and correct health and safety hazards. Unfortunately, these requirements are somewhat vague, and each building inspector has his/her own interpretation. The following formula is used to calculate a conversion cost.

What Is A Factory Overhead Cost Variance Report?

These costs can’t be traced back to a single unit in the production process. Some other examples of manufacturing overheads are insurance, building maintenance, machine maintenance, taxes, equipment depreciation, machining, and inspection. We shall use an example of a carpenter hired to make a bed.

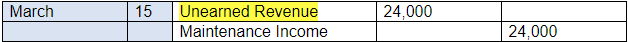

The conversion costs would also help in calculating the cost of goods sold accurately. Let us understand the calculation of conversion cost with the help of an example. Company A incurs the following expenses for producing units. Direct Wages – $19,000; Indirect Wages $2,500; Direct Material – $14,500; Indirect Material – $500; Equipment Depreciation – $3,250; and Factory Insurance $1,000. For simplicity, let’s assume there is no process inventory. Further, it is also a crucial cost accounting concept that assists in calculating the value of the finished inventory.

How Long Does Conversion Take?

Examples of manufacturing overhead are depreciation, utilities, rent, testing, and more costs that a company incurs within its manufacturing facilities. Examples of manufacturing overhead include the utilities, indirect labor, repairs and maintenance, depreciation, etc. that is occurring within a company’s manufacturing facilities. Prime costs and conversion costs include some of the same factors of production expenses, but each provides a different perspective when it comes to production efficiency. The manufacturing overhead will be the total overhead cost required for the manufacturing process to occur and the good to be produced. From a company’s perspective, the lower the conversion cost, the higher the profit margins.

- It is easier to track the materials and conversion costs for one batch and have those costs follow the batch to the next process.

- Beginning inventory does not appear in the balance sheet as organizations prepare financial statements at the end of the accounting period.

- Conversion costs, on the other hand, are expenses that a company incurs in converting raw materials into a finished product.

- Production costs are incurred by a business when it manufactures a product or provides a service.

- Direct labor costs include the wages and other benefit costs of all personnel who work directly in the production process and whose efforts can be directly traced to the products manufactured.

And this means, if you consider someone subscribing to your blog as a conversion, that’s what you are counting here. It is a metric that can help you get a better return on your marketing investments. As a result, businesses need to be proactive in making changes at the right conversion costs time. Beginning inventory refers to the total value of the inventory an organization holds at the start of an accounting period. Beginning inventory does not appear in the balance sheet as organizations prepare financial statements at the end of the accounting period.

How To Calculate Conversion Cost And Why Its Key For Your Companys Success?

Direct labor costs are the same as those used in prime cost calculations. In a processing environment, there are two concepts important to determining the cost of products produced.

Davis Still Seeking Input on Climate Action and Adaptation Plan – The People’s Vanguard of Davis

Davis Still Seeking Input on Climate Action and Adaptation Plan.

Posted: Tue, 30 Nov 2021 04:36:58 GMT [source]

The overhead component of total conversion cost is an indirect cost component and, thus, cannot be specifically traced to a particular product. Prime costs include cost of direct materials used and cost of direct labor employed. Learning about computing conversion cost is as simple as dividing the total amount spent on a marketing campaign by the number of conversions it results in. Once you calculate conversion, you can use the information to better allocate your budget and improve returns. Or you can use the conversion cost to confirm that your changes to campaigns were effective.

How To Calculate The Cost Of Sales

Expressed another way, conversion costs are the manufacturing or production costs necessary to convert raw materials into products. Expenses on transforming direct materials into the finished goods, excluding direct material cost, is known as conversion cost. It is taken as the aggregate cost of direct labour, direct expenses and factory overheads.

These are the concepts of equivalent units and conversion costs. As you have learned, equivalent units are the number of units that would have been produced if one unit was completed before starting a second unit. For example, four units that are one-fourth finished would equal one equivalent unit. Conversion costs are the labor and overhead expenses that “convert” raw materials into a completed unit.

Business

Understand the results and costs of your campaigns.Clever marketing is all about being proactive. And marketing metrics such as conversion costs help you in doing that.

i dont care what conversions are because our prices arent converted lolz our shit costs the same as yours and im getting it in australian conversions LMFAOOOO

— jaylen brown truther (@munkflow) November 26, 2021

Bruce is trying to figure out what his conversion costs are for the quarter in order to estimate his finished inventory for theinterim financial statements. This can include rolling one asset into some other form, such as moving the balance of a pension fund into a mutual fund, or converting one class of stock into another class.

If they were 100% complete with regard to conversion costs, then they would have been transferred to the next department. After all, your competitors will keep strategizing and coming back stronger. A point to note is that one may exclude individual costs from the calculation of conversion costs if a business does not incur them regularly. For instance, if certain expenses are for a specific production run, such as reworking parts to get the correct output, then we may exclude such costs.

David Ingram has written for multiple publications since 2009, including “The Houston Chronicle” and online at Business.com. As a small-business owner, Ingram regularly confronts modern issues in management, marketing, finance and business law. He has earned a Bachelor of Arts in management from Walsh University. You should also consider taking this to the next level by finding terms you are notbiddingon, but customers are using. To do so, visit the tab called “Search terms” to see what searches result in showing your ads. Try adding some of these keywords if they are not already in your campaign.

- And a better conversion rate will reduce the conversion cost.

- And it will increase your conversion rate and reduce the conversion cost.

- They are referred to as the manufacturer’s production related cost, which does not include the costs incurred in production of direct materials.

- Conversion cost is a managerial accounting concept applicable to the manufacturing industry.

Over the years, we have been involved in drafting many of the laws that govern SF conversions, and have helped develop many of the procedures used by the City in processing these applications. Our breadth of experience makes it likely that if a glitch appears in the condominium process, we will have seen something similar before and know exactly what to do. And for those rare occasions when a completely new issue arises, we are particularly adept at developing creative solutions that save our clients time and money. Our Documents Are Easy To Understand and Avoid Owner Disputes.Your CC&Rs will directly affect your quality of life, your financial investment, and your ability to refinance and sell. We take the time to be sure that your CC&Rs are customized to the building and the owners’ needs. Our CC&Rs are widely recognized as among the best in California, particularly for smaller buildings where we have set the industry standard. In a pre-conversion inspection, a private company recommends what you should do to prepare for the City building inspection in order to minimize the cost of conversion-related work.

Conversion costs are direct labor costs combined with manufacturing overhead costs. Direct labor costs are just the costs to employ those who actually make a product. Manufacturing overhead costs are things like indirect labor, utilities, supplies, equipment, insurance, taxes, tools, and regulatory obligations. We will look at these costs in more detail later in the lesson. Hence, using conversion costs is an efficient way of calculating equivalent units and per unit cost rather than separately calculating direct labor and manufacturing overheads. ABC International incurs a total of $50,000 during March in direct labor and related costs, as well as $86,000 in factory overhead costs. Therefore, the conversion cost per unit for the month was $6.80 per unit (calculated as $136,000 of total conversion costs divided by the 20,000 units produced).

For the basic size 5A stick, the packaging department adds material at the beginning of the process. The 5A uses only packaging sleeves as its direct material, while other types may also include nylon, felt, and/or the ingredients for the proprietary handgrip. Direct labor and manufacturing overhead are used to test, weigh, and sound-match the drumsticks into pairs. All prime costs have a direct one-to-one relation with products manufactured and can be directly traced to a specific product or products. For example, for a garment manufacturer, the quantum and cost of fabric used and man-hours and machine hours required to produce each type of garment can be specifically identified.

- A shop floor is the production area where people work on machines.

- Similarly, if it is horizontal drill alone it is a different GP% and if it is both horizontal + vertical drill the GP% is different.

- As such, calculating conversion costs in your manufacturing operation can provide distinct competitive advantages.

- Conversion Costsmeans the cost to convert the Granulations into Drug Product as set forth in Section 4.2 hereto.

- Compensation paid to machinists, painters, or welders is common in calculating prime costs.

- As said above, the conversion cost is the combination of manufacturing overheads and direct labor.

It helps to hire an attorney and a surveyor who the City processors know personally and feel comfortable calling or emailing if a problem arises. All materials on termscompared.com is subject to copyright and cannot be copied and republished without proir written permission. But it usually happens when business owners aren’t smart with the budget. Instead, they spend loads of money on campaigns that once worked for them. Or they don’t spend enough on campaigns that have the potential. You can have discussions with your marketing team regarding these non-profitable campaigns.

In the case of high conversion costs, there is always room for improvement. Conversion costs are also used as a way to measure the efficiencies in the production processes but they also take into account the overheads in the production process, which are not calculated in prime costs. A company’s accounts managers and production managers calculate these conversion costs to estimate the production expenses, the value of the finished and unfinished inventory, and make product-pricing models. The term conversion costs often appears in the calculation of the cost of an equivalent unit in a process costing system. Calculate the conversion cost by adding the direct labor cost to the manufacturing overhead.

What is Amazon conversion rate?

On Amazon, your conversion rate measures how many people who visit your product’s listing end up completing the action you want them to—in this case, making a purchase. A low Amazon conversion rate can signal an issue with your product, your listing, your price, your customer reviews, or a variety of other factors.

Whereas a panel saw machine will need one technician and one helper to turn the panel and to set it, so the GP% will be different. For example, beds will have a certain x% of GP whereas Study Tables will have a Y% of GP. But, eventually, if you drill down the costing, you might get some cost efficiencies. Examples of prime costs for a shoe manufacturer include leather, rubber, shoelaces, wages of all labor involved in assembly line and packing. Prime cost includes those costs that are directly related to manufacturing as well as are directly traceable to the products manufactured. These costs thus include only direct costs and are a core part of the total product cost.

What is fixed cost example?

Common examples of fixed costs include rental lease or mortgage payments, salaries, insurance, property taxes, interest expenses, depreciation, and potentially some utilities.

This article looks at meaning of and differences between two categorizations of product cots – prime cost and conversion cost. Manufacturing costs may be classified into prime and conversion costs. Calculating conversion costs can give you some vital insight into your marketing budget, either o digital or non-digital marketing worlds. It tells you where to spend the money and where not to, which becomes even more critical for small and medium-sized businesses.

Author: Mary Fortune

Be the first to comment